Thursday, March 12th, 2020.

Since I started paying attention to Bitcoin in 2011, I don't believe I've seen more of a tumultuous day than today (March 12, 2020). Every market alike, traditional and non-traditional is taking a beating.

I wish I could pump sunshine your way and tell you it'll get better. In the next 3-6 weeks, I believe it will only get worse. With the US-European travel ban, cancellation of major events, mass hysteria has just started to set in the United States. It's estimated in 7-10 days, the United States will have the same number of Coronavirus cases as Italy does today. In that time frame, presumably the US will have the same response as Italy: complete economic shutdown. Other countries are following a similar pattern.

The continuation of mass hysteria will likely cause all markets to continue to drop, likely through March. As traditional markets continue to drop, central banks will do what central banks do: continue to print more money and bailout private companies that made bad decisions.

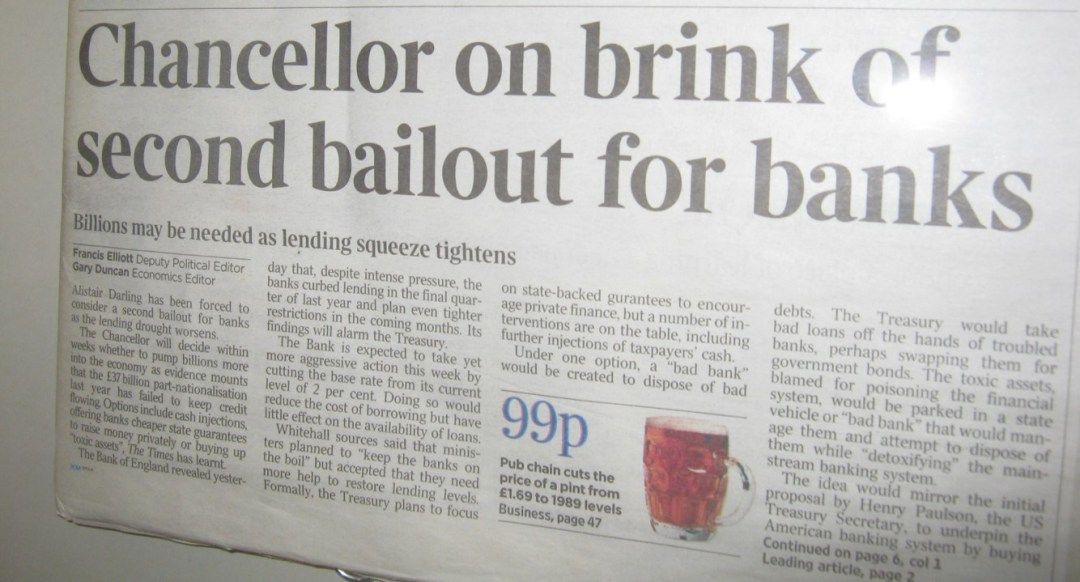

Satoshi designed Bitcoin for us to ultimately take back control of money from reckless governments and their endless money printing presses. Presumably this is what he intended as you only need to read the message encoded in the Bitcoin genesis block to guess his motivations:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

I had hoped Bitcoin would be uncorrelated with traditional markets, but the events of today and last week have showed us it's still correlated. For now.

Today, the US Federal Reserve (Fed) committed to pumping in $1.5 trillion of liquidity into the market. Last week the Fed dropped the interest rate 0.5%. The market didn't react positively to either of the Fed's actions. The Fed is meeting next week, likely to drop interest rates further, possibly to 0% again. As crazy as it sounds, it doesn't have to stop at 0%. Interest rates can go negative.

The timing of all of this is certainly interesting as the Bitcoin halving is just months away. We may be witnessing the start of a complete financial reset. I don't know how long it'll take or when things will get better. But in the end, things will look much different than they do today.

At Exodus, I believe we are uniquely positioned to ultimately help the world and fulfill Satoshi's vision. We're remote, world-wide, all of us taking salaries in BTC. Building software for a better financial future. We just have to keep building.

But please, above all else, take care of yourselves and your families first.

This content is for informational purposes only and is not investment advice. You should consult a qualified licensed advisor before engaging in any transaction.